The Fei Protocol team asked us to review and audit their Protocol smart contracts. We looked at the code and now publish our results.

Scope

We audited commit 29aeefddd97f31c7f2a598fb3dca3ef24dc0beb4 of the fei-protocol/fei-protocol-core repository. In scope were the contracts directly inside the /contracts folder, however the contracts within /contract/mocks were out of scope. Note: the repository in question is private at the time of writing, so many hyperlinks will only work for the Fei team.

System overview

Fei Protocol is the first protocol creating a stablecoin using a new stability mechanism called direct incentives. This stablecoin, named FEI, is not fully collateralized, but instead uses a system of incentives to encourage trading activity that brings the token back to its USD peg. This is achieved by attaching incentives to trades through an ETH/FEI Uniswap Pair, that mint or burn FEI tokens in certain situations.

The protocol uses a bonding curve to price FEI, implements a Protocol Controlled Value to enable the incentive design, and has a governance token called TRIBE to allow user-controlled upgrades to the system

Below we summarize some of the key aspects of the Fei Protocol.

Protocol Controlled Value

In many DeFi applications, all of the funds deposited within the protocol actually belong to a user, and the user is minted tokens to represent the amount that the protocol owes them. Protocol Controlled Value (PCV) instead is money that the protocol owns outright – that is not owed to a user. This value is what allows the protocol to provide incentives and influence market conditions. The protocol’s bonding curve is what allows the protocol to calculate and accrue PCV.

Genesis Period

The Genesis period is 3 days in which a contract known as the GenesisGroup collects the ETH needed to bootstrap the protocol. During this time, any user can deposit ETH into the contract, and receive FGEN tokens in return. These tokens entitle the user to an amount of FEI and TRIBE tokens as a reward after launch. Users contributing to the Genesis are guaranteed that they will receive FEI at a maximum price of $0.90, which should then be pegged to $1 after launch and after a thawing period.

The Genesis period ends after 3 days, or earlier if the protocol collects enough ETH. The contract will then add liquidity to the FEI/TRIBE and ETH/FEI Uniswap pools, initialize the bonding curve oracle, and deposit rewards back into the GenesisGroup contracts for contributors to collect.

Fei Reward pool

After the Genesis period ends, the Fei Reward Pool is initialized. Users can deposit FEI and TRIBE in the FEI/TRIBE Uniswap pool to get FEI/TRIBE liquidity pool tokens and stake them into the Fei Reward Pool to earn TRIBE. Initially, the pool will hold 20% of TRIBE‘s total supply and will release them over the course of two years.

Incentive contracts

Incentive contracts control the direction and magnitude of incentives for each FEI transfer. The incentive contract can either be a minter, a burner or both. When a user sends FEI to an incentivized address, the final balance after the transfer will either be affected by a mint or burn incentive. The primary incentivized address in Fei Protocol is the FEI/ETH Uniswap pool. When the FEI/ETH price is below the peg, the incentive contract will mint FEI to traders on a buy operation, taking into account a time-weighted magnitude of the distance from the peg. When a user sells FEI at or below the peg, the trade is disincentivized by a dynamic burn mechanism. Similar to the mint, the burn will take into account the distance from the peg, but does not depend on time.

Privileged roles

At deployment, the Fei team will set the admin address for the protocol. This protocol admin will be granted high-level permissions, becoming a Governor, Revoker, and Guardian in the system. The admin will also be the beneficiary in the IDO contract.

The admin will be able to:

- Add and revoke roles,

- Perform emergency reweights to restore the

FEIpeg, - Modify the

scale,buffer, andallocationsof the bonding curve, - Change the address of the

FEItoken, - Transfer/allocate unallocated

TRIBEtokens, - Flip the kill switch for the bonding curve oracle,

- Change the oracle durations used to calculate time-weighted average prices,

- Change the protocol controlled value (PCV) deposit address,

- Change the reweight incentive amount,

- Change the minimum distance from the peg required for reweight incentivization,

- Change incentive contract addresses,

- Add and remove addresses that are exempt from incentivizations,

- Change the growth rate and time weight for the incentivization calculations,

- Withdraw

FEIfrom the Uniswap pool back to the protocol treasury, - Setup new token pairs for use by the protocol,

- Change oracle addresses,

- Change the genesis group address,

- Assign a new beneficiary for the IDO contract

There are functions in place to transfer these roles to other addresses and to allow for the abdication of the Guardian role in the future.

In addition to these roles, there are also Minter, Burner, and PCV Controller roles. The Governor can assign these roles to any address, and has all of their abilities.

They can:

- Mint new tokens,

- Burn tokens held by any address

Security model and trust assumptions

Voters use TRIBE to vote. It is paid out to liquidity providers, traders, and referrers. TRIBE can be delegated and is transferable. The voting system has the ability to arbitrarily update many critical variables and contracts. This includes the ability to change pricing oracles, which means the voting system has all the powers of an oracle, along with many more. In this audit, we assume that the voters will not pass proposals that would harm FEI.

The Fei protocol is pegged to the exchange rate of ETH/USDC as a proxy for ETH/USD. Therefore, FEI is exposed to the risks inherent in USDC. In this audit, we do not assess the risks in the USDC protocol and their effects on the Fei protocol.

The Fei protocol is initialized to use the Uniswap pricing oracle, which is integral to the system. During this audit, we assumed that the administrator and price feeds are available, honest, and not compromised.

Findings

Here we present three client-reported issues, followed by our findings.

Bypass burn penalty (client reported)

The client reported an economic vulnerability that could be used to bypass the burn penalty applied upon selling FEI. Contracts which hold pooled FEI owned by users and with the ability to withdraw to an arbitrary address, the following attack is possible:

- Withdraw

FEIfrom the pooled contract to theFEI/ETHUniswap pool. - The burn penalty is then borne by the contract which holds

FEIpooled from other users. - Execute the swap on Uniswap to receive ETH.

This attack can be executed by a secondary Uniswap market, or other contracts that pool ERC20 tokens. This has been addressed in PR#10.

Rounding errors during reweight (client reported)

The client reported an issue that affects the accuracy of reweighting to re-establish the peg. If a reweight happens when the protocol is the only liquidity provider, the dust left in the Uniswap pool prevents accuracy when reweighting the peg. The error can be over 5% at times. This has been addressed in PR#22.

Attacker can manipulate ETH/FEI spot price on allocations (client reported)

The client reported a vulnerability in which an attacker can manipulate the spot price of the ETH/FEI Uniswap pool by performing a flash loan to borrow ETH and buy FEI, moving the price up right before an allocation is executed, and sell that FEI amount after the allocation is done to make a profit. This has been addressed in PR#81.

Update

Most of the following issues have been either fixed, partially fixed, or acknowledged by the Fei Team. Our analysis of the mitigations is limited to the specific changes made to cover the issues, and disregards all other unrelated changes in the pull requests and in the codebase.

Critical severity

[C01] Anyone can steal all the TRIBE tokens from the reward pool

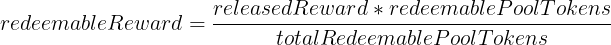

The FeiPool contract allows users to deposit FEI/TRIBE liquidity pool (LP) tokens and earn TRIBE tokens as a reward. The amount of TRIBE that a user can claim is given by the following formula:

Where releasedReward is the total amount of released reward tokens from the total amount available, redeemablePoolTokens is the amount of reward tokens that the user can claim, and totalRedeemablePoolTokens is the total amount of redeemable pool tokens by all the stakers participating in the pool. Both redeemablePoolTokens and totalRedeemablePoolTokens increase over time, which means that the more time the user leaves their stake in the pool, the more rewards they will be able to claim.

The issue lies in the fact that burnFrom function from the Pool contract allows anyone that holds LP tokens to burn them and, therefore, manipulate the amountReward value returned by the redeemableReward function. An attacker can do the following:

- Deposit an amount of

FEI/TRIBELP tokens when the pool opens from two different accounts,account Aandaccount B. - Let some time pass so that the numerator in the formula that calculates the

amountRewardvalue equals or is near the pool’srewardBalance, which includes both the released and unreleased rewards. This will not take much time since the numerator is proportional to the released amount of rewards given by thereleasedRewardfunction, the number of tokens staked, and the remaining time of the pool. - Burn an amount of

_totalRedeemablePoolTokens - 1pool tokens fromaccount B. This way, the denominator in the formula will equal1, and theamountRewardvalue returned by theredeemableRewardfunction will equal the pool’srewardBalanceas calculated in 2. - Withdraw or claim rewards from

account A. - Wait until the pool closes and withdraw staked tokens from

account B.

Since the FeiPool contract holds 20% of TRIBEs total supply, the attacker would be stealing 200,000,000 TRIBE tokens in the worst case. A step-by-step proof-of-concept exploit for this scenario can be found in this secret gist.

Consider disallowing external burns by removing the ERC20Burnable inheritance from the Pool contract, and only allow burning to be an internal operation triggered by claiming rewards.

Update: Fixed in PR#32. The FeiPool contract no longer inherits from the ERC20Burnable contract. Additionally, the burnFrom public function was removed, and a new _burnFrom function was added to be used in the _withdraw function.

[C02] ETH can get stuck in the GenesisGroup contract

The GenesisGroup contract allows users to contribute ETH by using the purchase function, which mints them FGEN tokens to record the size of their deposit. When enough ETH has been contributed to reach the maxGenesisPrice, or the genesis period has ended, the launch function can be called to transfer all the ETH collected to PCVDeposit contracts, and launch the rest of the protocol. After launch has completed, users can call the redeem function to cash in their FGEN tokens for their share of FEI and TRIBE tokens.

However, if the launch function gets called due to the maxGenesisPrice being reached, the contract does not prevent purchase from being called by users. This would likely happen when users race to contribute to the genesis before launch. This has the following negative consequences:

- The ETH deposited by users will become locked in the

GenesisGroupcontract. This is due to the fact thatlaunchis the only function that can transfer ETH out of theGenesisGroup, and it cannot be called a second time – enforced bycompleteGenesisGroupreverting if someone tries to calllauncha second time. - The additional calls to

purchasecontinue to mintFGENto the callers. This increases thetotalSupplyofFGEN, and skews the calculation in_fgenRatio, meaning that valid contributors to theGenesisGroupwill not receive their rightful allocation ofTRIBEandFEI.

Consider adding a condition to the purchase function that prevents it from being called if hasGenesisGroupCompleted is true.

Update: Fixed in PR#24. The Fei Team decided to remove the isAtMaxPrice condition that allowed the protocol to be launched before the genesis period passed. Additionally, a condition was added to check whether the genesis was launched when calling the purchase function.

[C03] Anyone can partially bypass the FEI sell penalty to earn a profit

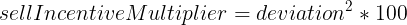

The UniswapIncentive contract defines the incentives to be applied when users buy or sell FEI tokens in the ETH/FEI Uniswap pool. On the one hand, when a user sells tokens and causes a deviation in the price peg, a sell penalty is applied and the protocol burns a portion of their tokens. This penalty is calculated using the following formulas:

Where deviation is the price deviation from the peg caused by selling an amountSold amount, and amountSold is the amount sold by the user. This sell penalty will be burned from the user’s account after the sell operation is performed.

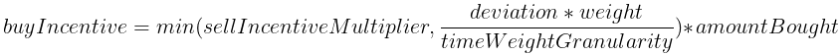

On the other hand, when a user buys FEI tokens to move the price back towards the peg, a buy incentive is applied and the protocol mints tokens to them. This incentive is calculated as follows:

Where deviation is the price deviation from the peg before buying the amountBought amount, weight is the time-weighted function, timeGranularity is the granularity, and sellIncentiveMultiplier is the sell penalty multiplier described above. Notably, when the buyIncentiveMultiplier is equal or greater than the sellIncentiveMultiplier, incentive parity is reached, and the EthUniswapPCVController contract may be able to do a reweight to move the price back to the peg if necessary.

Since the sellIncentiveMultiplier function is quadratic, performing several small sell operations results in a considerably lower total penalty than performing one large sell operation, each of which take the FEI price from deviation A to deviation B.

This means that an attacker would be able to buy a X amount of FEI to move the price from deviation B to deviation A and get the buy incentive described above (capped at the sell incentive multiplier), and then sell the same X amount of FEI in multiple sell operations to move the price back from deviation A to deviation B. This could significantly reduce the sell penalty, and the attacker will retain a profit. Notably, the maximum profit will be reached when the incentive parity is reached.

Moreover, since performing a buy operation in the first place will either decrease or reset the time-weight function, other users may not have enough incentive to move the price back to the peg, and since there will no longer be incentive parity, the EthUniswapPCVController will not be able to do a conventional reweight, instead having to use the force reweight function.

Consider revising the sell incentive multiplier formula so that multiple sell operations will not decrease the sell penalty, or consider revising the buy incentive multiplier so that even after performing multiple sell operations, the attack is not profitable.

Update: Fixed in PR#63. The buy incentive multiplier was capped to 30% of the sell incentive multiplier to make this attack unprofitable.

[C04] Users can claim unreleased rewards or have their funds locked

The FeiPool contract allows users to deposit FEI/TRIBE liquidity pool (LP) tokens into the Fei Pool to accrue TRIBE tokens as a reward. After some time, users may want to withdraw their LP tokens and get the accrued rewards. To track users’ staked amounts and the total staked amount in the pool, the contract defines the stakedBalance and totalStaked variables, respectively. These are incremented each time a user deposits liquidity pool tokens into the pool.

When a user withdraws their staked tokens and accrued rewards, only the user’s stakedBalance is updated, while the totalStaked variable remains the same. Since the redeemableRewards function depends on the totalStaked variable to compute the amount of redeemable rewards in the _totalRedeemablePoolTokens function, the total amount of redeemable tokens for the user is miscalculated, resulting in more tokens being released than what was intended.

Additionally, since the Fei Pool’s total supply of tokens decreases during claims and withdrawals, while the totalStaked variable is unchanged, the balance variable from the _totalRedeemablePoolTokens function could become greater than the total variable. This would prevent users from claiming rewards and withdrawing their stake due to a “Redeemable underflow” require statement.

Consider decrementing the totalStaked variable in the _withdraw function to accurately track the total stake in the pool and avoid these scenarios.

Update: Fixed in PR#19. The totalStaked amount is now being decremented in the _withdraw function.

[C05] Anyone with enough liquidity to reach the maxGenesisPrice can make profit from genesis

The GenesisGroup contract allows users to deposit ETH through the purchase function in exchange for FGEN tokens, which represent the proportion of the total ETH in the contract that the user deposited. After the genesis period has ended or after the maxGenesisPrice has been reached, the protocol can be launched via the launch function (which can be called by anyone). After the protocol is launched, users will be able to redeem FEI and TRIBE tokens proportional to the amount of FGEN tokens they own.

Since all of the operations mentioned above can be executed in the same transaction, a flash loan could be used to steal ETH using the following attack:

- Borrow the amount of ETH necessary to increase the average price to the

maxGenesisPrice. - Launch the protocol by calling the

launchfunction. This operation will:

– Initialize the bonding curve oracle, which will start with an initial price that equals the maxGenesisPrice.

– Purchase FEI in the bonding curve so that users can redeem them.

– Add liquidity to the FEI/TRIBE Uniswap pool at an exchange rate based on the amount of FEI purchased in the genesis period, the amount of TRIBE held by the IDO contract and the exchangeRateDiscount variable.

– Add liquidity to the ETH/FEI Uniswap pool.

3. Call the redeem function to withdraw FEI and TRIBE tokens based on the ratio of FGEN owned.

4. Sell all the TRIBE earned in exchange for FEI in the initialized FEI/TRIBE Uniswap pool.

5. Sell all the FEI (earned from the redeem function, and from selling TRIBE) in the initialized ETH/FEI pool in exchange for ETH.

6. Repay the loan and keep the remaining ETH as profit.

The amount used by the attacker should be such that they can afford the price impact on Uniswap’s ETH/FEI pair, and still make profit. A spreadsheet that calculates this amount can be found here.

If this attack is performed, then:

- The

ETH/FEIUniswap pool price will be below the bonding curve oracle’s peg, forcing a reweight, or other users in the system will try to restore the peg by interacting with the incentive contracts. - The

ETH/FEIUniswap pool will be launched with less ETH than expected. - The

FEI/TRIBEpool will be launched with lessFEIand a lower price than expected. - The attacker will steal around 800,000 USD in ETH from the protocol.

Note that this attack is feasible even without a flash loan, for example, by a user with enough liquidity to reach the maxGenesisPrice with a purchase.

Consider flagging the block where the maxGenesisPrice is reached in a global variable and restricting the launch function to only be called when the current block number is higher than this value. Additionally, consider revising the exchangeRateDiscount amount so that this scenario is not profitable for a user with enough liquidity nor for an attacker using a flash loan.

Update: Fixed in PR#27. The flash loan attack was fixed by disallowing to launch the protocol and redeem FEI and TRIBE in the same transaction. Additionally, the initial bonidng curve oracle price has been decreased to drastically reduce the profit that users with enough liquidity would make by selling all their FEI and TRIBE tokens right after the protocol is launched.

High severity

[H01] Users participating in Genesis can get fewer FEI and TRIBE than expected

The GenesisGroup contract stops the genesis period earlier than its duration, if enough ETH has been contributed to reach the maximum price of FEI paid by the Genesis Group. This attractive maximum price incentivizes users to contribute to the GenesisGroup to bootstrap the protocol.

However, the GenesisGroup continues to accept purchase calls after the maxGenesisPrice has been reached. Even with a solution to ETH can get stuck in the GenesisGroup contract issue, purchase transactions will continue to be accepted until the launch function is called. These additional purchases could push the average price for the GenesisGroup far above the maxGenesisPrice, causing contributors to receive fewer FEI and TRIBE tokens than expected. In extreme cases, users could end up receiving FEI that is valued at less than their ETH investment (measured in USD).

Consider implementing a check in the purchase function that prevents it from being executed if the purchase causes the maxGenesisPrice to be exceeded. Notably, if the maximum price has not been reached, but a purchase would cause the maximum price to be exceeded, some or all of the purchase amount should be rejected.

Update: Fixed in PR#24. The Fei Team decided to remove the isAtMaxPrice condition to allow the protocol to be launched before the genesis period passed, and added a condition to check whether the genesis was launched when calling the purchase function. Additionally, the initial FEI price has been capped in the BondingCurve contract so that it does not exceed the buffer adjusted amount, which means that if enough ETH is collected in genesis, users will not benefit from a discount in FEI.

[H02] Outdated oracle prices being used throughout the protocol

Throughout the system, the UniswapOracle contract and the BondingCurveOracle contract are used to read the current USDC/ETH and FEI/ETH prices respectively. These prices are used throughout the protocol to peg the price for FEI, and so are of critical importance in the system.

While the oracle is updated using the update function in a number of function calls, there are some calls within the system that read the price without updating it first. We understand that the Fei team is intending to manually update the oracle, however this poses a risk during times of high-volatility or high network-congestion.

Locations in the code that do not update the oracle price include:

- Within the function

reweightin theEthUniswapPCVControllercontract, the function first determines whetherreweightEligible. To determine this, it calculates the deviation from the current peg. However this peg is fetched without first updating the Uniswap Oracle. This means that the determination of whether to reweight is based on an outdated price, and the protocol could end up not reweighting when it should. - The call to

isAtMaxPriceto determine whether theGenesisGroupcan executelaunchreads thepegwithout updating it. This might cause the protocol to launch before the max has been reached, or to not launch when it should. - Functions in the

BondingCurvecontract that rely on thepeg, for examplegetCurrentPrice, andgetAdjustedAmount. - The

thawfunction in theBondingCurveOraclewhich calculates the thawed FEI price based on the current Uniswap price.

Consider ensuring that all function calls that read an Oracle price execute a call to update before reading it.

Update: Fixed in PR#28. The issue was fixed in the reweight function of the EthUniswapPCVController contract, and the isAtMaxPrice check was removed from the launch function of the GenesisGroup contract.

[H03] Incentive to support the peg decays with volatility

The FEI protocol incentivizes supporting the peg by minting extra FEI to users that buy FEI from the Uniswap pool. The incentive is a function of the growth rate, the time since the peg was last restored, and the distance from the peg. A struct containing a blockNo, weight, growthRate, and active flag tracks this info in the timeWeightInfo variable. The timeWeightInfo.growthRate is initialized as 333, and only updated through governance.

The updated weight and price deviations are inputs to the updateTimeWeight function, which updates the timeWeightInfo.weight through the _setTimeWeight function. Whenever a buy is performed, the price deviation and updated weight is factored into the calculateBuyIncentiveMultiplier function to determine the incentive, whereas the weight is not factored into the calculateSellPenaltyMultiplier function which calculates the disincentive for selling. Upon each transaction, incentivize is called, which calls either incentivizeBuy or incentivizeSell depending on the direction of the trade. Regardless of the direction, updateTimeWeight is called, but this function differs for buy and sell transactions, with an asymmetric effect that reduces the incentive for buyers when there is price volatility below parity.

Suppose, for example, the protocol starts at parity, which sets the weight to 0. Then the following sequence of transactions occur:

- A large sell pushes the price down to

0.9. FirstgetTimeWeightwill be called, and return0, because no blocks have passed since the peg was last at parity. In the same transaction,updateTimeWeightis called with parametersweight = 0,initialDeviation = 0,finalDeviation = 0.1. As a result,updateTimeWeightcalls_setTimeWeightto updatetimeWeightInfo.weightto0andtimeWeightInfo.blockNoto the current block height. - Next, a hundred blocks later, a ‘partial’ buy is submitted, which would bring the price up to

0.95. First,getTimeWeightwill be called. TheblockDeltawill now be100, and thetimeWeightInfo.growthRateremains333. The product (33300) is added to the previously storedtimeWeightInfo.weight(0), and the sum of33300is returned. In the same buy transaction,updateTimeWeightwill be called, and passed the parameters:weight = 33300,initialDeviation = 0.10, andfinalDeviation = 0.05. Since the peg was only partially restored,updateTimeWeightreduces the weight byremainingRatio = finalDeviation / initialDeviation = 0.5. Then, when_setTimeWeightis called,timeWeightInfo.weightis updated to33300 * 0.5 = 16650, and the current block height is stored intimeWeightInfo.blockNo. - One block later, another sell happens, pushing the price back down to

0.9. This time, whengetTimeWeightis called, theblockDeltawill be1andtimeWeightInfo.weightwill be16650, so the function returns a weight of16650 + 1 * 333 = 16983. In the same sell transaction,_setTimeWeightis called, updatingtimeWeightInfo.weightto16983and updatingtimeWeightInfo.blockNo. - One block later, with the price back down to

0.9, suppose a buyer makes a purchase of any size. WhengetTimeWeightis called, theblockDeltais1, and thetimeWeightInfo.weightis16983, so the function returns16983 + 1 * 333 = 17316.

The weight is factored into the incentive for buyers. The higher the weight, the greater the incentive. When the first buyer submitted an order where the initial price was 0.9, the weight was 33300. When the second buyer submitted an order two blocks later with the same initial price of 0.9, the incentive had dropped to 17316. This is because partial buys reduce the timeWeightInfo.weight by the ratio of the partial buy, but sells do not increase the timeWeightInfo.weight by the inverse ratio. Buyers only realize the full incentive if the first buyer makes a purchase that fully restores the peg to parity, or if sells never happen after partial buys. Otherwise, the incentive for buyers to support the peg decays with price volatility below parity.

If the incentive decays such that buyers are no longer incentivized to support the peg, the PCVController would have to step in to re-establish parity using forceReweight.

Consider updating the sell functions to re-incentivize subsequent buying to support the peg.

Update: Acknowledged. The Fei Team states that this is an expected behavior of the protocol.

Medium severity

[M01] Malicious actors can lock all FEI and TRIBE in the GenesisGroup

The GenesisGroup contract calculates whether or not the maxGenesisPrice has been reached using address(this).balance. While this balance is usually indicative of how much ETH has been deposited using the purchase function, malicious actors can increase the contract’s ETH balance directly using selfdestruct. Performing a selfdestruct allows the attacker to bypass the checks and token minting performed in an execution of purchase, merely altering the balance directly.

While incredibly unlikely, if an attacker were to selfdestruct enough ETH into the GenesisGroup for the contract to reach the maxGenesisPrice, they could call launch to bootstrap the protocol while leaving the FGEN.totalSupply at 0. With 0 FGEN in existence, no users would be able to exeucte redeem to extract the FEI and TRIBE balances from the contract, leaving them locked inside. If an attacker instead deposited a smaller amount of ETH using selfdestruct, they would cause each valid contributor to receive more FEI and TRIBE than they were intended to receive.

While such an attack has no clear motivation, it can still affect the state of the system. Consider performing price calculations using FGEN.totalSupply instead of address(this).balance in both isAtMaxPrice and launch so that a selfdestruct would not affect the system.

Update: Not fixed. In the words of the Fei team: “Did not fix because it is an obscure vector which is pure self-inflicted loss”.

[M02] Inverse price fetched from Uniswap

The UniswapOracle contract keeps track of the Uniswap price of USDC for use throughout the protocol and stores the price as USDC-per-WETH. The update function checks the price on Uniswap and, subject to some conditions, updates the price in the oracle. When checking the Uniswap price, Uniswap returns price0Cumulative and price1Cumulative, which contain the WETH-per-USDC and USDC-per-WETH prices, respectively. The boolean isPrice0 is then used to flag whether Uniswap’s price0Cumulative is the correct price to use in the oracle – and if isPrice0 is false, the oracle instead uses price1Cumulative.

However, the value of isPrice0 is initialized incorrectly. The protocol initializes this value to true, but it can be seen in Uniswap’s code that price0Cumulative actually holds the price of WETH-per-USDC, and price1Cumulative, instead, holds the price of USDC-per-WETH.

Due to the fact that the update function later performs an inversion, the final price is correctly stored as USDC-per-WETH. However, the inversion may cause a loss of accuracy on the USDC-per-WETH rate. Furthermore, the code is confusing to understand due to the false statements about what is being fetched from Uniswap and the lack of explanation regarding the inversion.

Consider fetching the USDC-per-WETH from Uniswap, as implied by the code, and updating the logic to no longer invert the fetched price.

Update: Fixed in PR#21.

[M03] Rounding errors in Roots library reduce FEI received from bonding curve

The Roots library implements a cubeRoot function. It then implements a twoThirdsRoot function which calls cubeRoot. This twoThirdsRoot function can have large rounding errors due to the order of operations. The cubeRoot function returns a truncated integer, which is then squared in the twoThirdsRoot function. The effect is that the twoThirdsRoot function is biased downwards, potentially significantly depending on the scale. For example, twoThirdsRoot(124) returns 16, whereas the true value is approximately 24.87.

The Roots library also implements a threeHalfsRoot function which suffers the same downward bias caused by incorrect order of operations. This threeHalfsRoot function calls the sqrt function which returns a truncated value. The threeHalfsRoot function then raises the truncated value to the power of three. Again, results may significantly deviate from expected values. For example, threeHalfsRoot(8) returns 8, whereas the true value is approximately 22.63.

The threeHalfsRoot and twoThirdsRoot functions are called from the _getBondingCurveAmountOut function, which is used to calculate the amountOut for every purchase made before the protocol reaches scale via the getAmountOut function.

As is, the twoThirdsRoot and threeHalfsRoot functions scale well, with relatively small percentage errors on big numbers. By changing the order of operations in the twoThirdsRoot and threeHalfsRoot functions, we observed a decrease in the propagated discrepancy in the BondingCurve test for the Pre Scale scenario which checks for the CorrectFEIsent. Do note, the test was written to expect a value of 51529, but the correct value is 51977, so the test fails after increasing the accuracy of the twoThirdsRoot and threeHalfsRoot functions.

Consider combining the arithmetic functions and changing the order of operations such that truncating steps are performed last while being mindful of potential overflows.

Update: Fixed in PR#31. In the words of the Fei team: “This change reduced the error by 1-2 orders of magnitude on the number ranges in this test class”.

[M04] Incorrect proposal and quorum thresholds for voting

Tribe tokens are used for governance, with the totalSupply set to 1 billion tokens with 18 decimals. The amount of Tribe required to reach the proposalThreshold for a vote is only 0.01% of Tribe supply, although the comments indicate this should be 1%. Likewise, in order for a vote to succeed, the quoromVotes requires only 0.1% of Tribe supply, although the comments indicate this should be 10%. These inconsistencies should be resolved.

Update: Fixed in PR#. The amount of quorum votes was changed to 25,000,000 (2.5% of Tribe’s total supply), and the proposal threshold was changed to 2,500,000 (0.25% of Tribe’s total supply).

[M05] ETH and FEI can get locked in EthUniswapPCVDeposit

The deposit function in EthUniswapPCVDeposit takes an ETH amount, mints an amount of FEI, and uses these to add liquidity to the ETH/FEI Uniswap Pool. The precise amount of FEI to mint is calculated in the _getAmountFeiToDeposit function.

When accepting liquidity, the Uniswap contract calculates the precise ratio needed to maintain the current price, and will not accept liquidity in a different ratio. In the case of a token, this means Uniswap fetches the exact token amount using transferFrom, and, in the case of ETH, Uniswap returns any excess ETH deposited to the sender. The deposit function does not handle the case where Uniswap does not accept 100% of the ETH and FEI as liquidity. This means that if _getAmountFeiToDeposit calculates the incorrect amount of FEI and ETH to deposit, FEI or ETH will become locked inside the EthUniswapPCVDeposit contract.

There are two reasons that the _getAmountFeiToDeposit might incorrectly calculate the ratio of FEI to ETH:

- Fei’s

_getAmountFeiToDeposit. and Uniswap’s_addLiquiditycalculate the amounts to deposit slightly differently: Fei calculates theFEIneeded given the reserve sizes and an ETH amount, whereas Uniswap calculates the ETH needed given the reserve sizes and aFEIamount. While this difference is minimal, it leads to small differences in the amounts to deposit. _getAmountFeiToDepositdoes not always use the actual reserve amounts from Uniswap. The functiongetReservesalters theFEIreserve amount used in calculations if the Uniswap Pair’sFEIbalance is larger than the reserve amount, leading to a difference in the ratio used in calculations.

Consider implementing logic to handle any FEI or ETH that remains in the EthUniswapPCVDeposit contract after adding liquidity to Uniswap. Alternatively, consider altering the calculations to exactly mirror those performed in Uniswap.

Update: Fixed in PR#30. The EthUniswapPCVDeposit now burns the dust FEI after adding liquidity to the ETH/FEI Liquidity Pool, and dust ETH is tacked onto the next deposit.

[M06] Incentive does not initialize when Ether depreciates

Once FEI reaches parity with USDC, there are 2 ways for the FEI price to fall below the peg: either by users selling FEI (which the protocol handles) or by ETH depreciating against USDC. There is no incentive to support the peg if ETH depreciates against USDC, because:

- When the price is above the peg,

timeWeightInfo.activeis set to false. - If the

FEIprice naturally drops without users trading (i.e., by ETH depreciation againstUSDC), nothing triggers updates to thetimeWeightInfovariables. - The

getTimeWeightfunction returns0whentimeWeightInfo.activeis false. - The

calculateBuyIncentiveMultiplierfunction returns0when weight is0, regardless of the deviation.

Nothing forces the time-weighted incentive to become active except trading. Therefore, if FEI depreciates because Ether has depreciated against USDC, nothing incentivizes buyers to support the peg. Some trading activity would need to happen (i.e., selling, or an unincentivized buy) to start the time-weighted incentive. In such a case where a trade happens after Ether depreciates, the time-weighted incentive is measured from the block where the trade was executed, and not the block when FEI first fell below the peg due to Ether depreciation. In practice, this could also lead to prospective buyers monitoring the mempool for trades against the incentivized address, intending to back-run those transactions to capture an incentive.

Consider adding an incentive for buys when the initial price is below the peg even if the time-weighted period has not yet been initialized.

Update: Acknowledged. In the words of the Fei Team: We acknowledge that this is an issue but we expect natural arbitrage and trading activity to initialize it within a reasonable time frame.

Low severity

[L01] Approved addresses can forfeit user rewards

Holders of FPOOL tokens are entitled to rewards from the FeiPool contract. When the rewards have been collected using the claim function, the user’s FPOOL tokens are burned. The situation is analogous with FGEN tokens in GenesisGroup, with rewards collected using redeem, which burns the FGEN tokens.

As with all ERC20 tokens, holders of FPOOL and FGEN can approve other addresses to transfer their tokens on their behalf. However, with FPOOL and FGEN, these approved addresses are given an extra power: they can burn the user’s tokens, forfeiting reward collection. This forfeiture of user rewards also increases the amount of rewards other token holders are entitled to, as rewards are split proportionally between holders.

While it is assumed that users trust the addresses that they are approving, these external burnFrom functions seem to serve no purpose in the system, and so the increased risk could be removed.

Consider changing the FPOOL and FGEN tokens to be ERC20 instead of ERC20Burnable. Functions that need to perform token burns can use the internal _burn function to do so, and additional allowance checks can be added if a third party is calling the function.

Update: Fixed in PR#32. The FeiPool contract no longer inherits from the ERC20Burnable contract. Additionally, the burnFrom public function was removed, and a new _burnFrom function was added to be used in the _withdraw function.

[L02] Authorized burners can burn FEI balances without an amount restriction

The Protocol uses a “Burner” role to manage permissions around token burning, which the incentivization model requires.

The burnFrom function in the Fei contract uses the internal _burn function from the OpenZeppelin ERC20 implementation instead of using the burnFrom function from the OpenZeppelin ERC20Burnable implementation.

The _burn function from ERC20 does not check allowances before performing the burn action. Currently, calling the burnFrom function from the Fei contract will allow a Burner to burn any amount of FEI from any account without restriction. In the event that a Burner role address gets compromised, this could present more risk to the protocol than necessary. On the other hand, the more restrictive burnFrom function from ERC20Burnable considers allowances before burning tokens, which could help lessen the impact of a rogue Burner.

For the FEI token, consider using the burnFrom function from ERC20Burnable rather than the _burn function from the ERC20 contract to minimize risk.

Update: Acknowledged. In the words of the Fei team: “We feel that this risk is appropriate as the burner should not need ERC20 approval and is only given to one contract”.

[L03] Core contract cannot allocate all Tribe tokens

The function allocateTribe in the Core contract is used to distribute TRIBE tokens to specified addresses. A percentage of TRIBE tokens remains undistributed as a treasury. According to the Fei whitepaper, the community can distribute this as it sees fit as the protocol develops.

However, in the allocation process, the function requires that the amount to be distributed is strictly less than the contract’s TRIBE balance. This means that the contract cannot allocate all of the TRIBE tokens it holds, and a single unit of TRIBE will be locked in the contract.

Consider changing the require statement to use >= instead of >, so that all of the TRIBE it holds can be allocated.

Update: Fixed in PR#33.

[L04] Multiple outdated Solidity versions in use

Outdated versions of Solidity are being used in all contracts. The compiler options in the truffle-config file specifies version 0.6.6, which was released on April 6, 2020. Throughout the codebase there are also different versions of Solidity being used. For example, most of the Solidity files specify supported versions ^0.6.0, while the following files specify supported versions ^0.6.2:

As Solidity is now under a fast release cycle, consider using a more recent version of the compiler, such as version 0.7.6. In addition, to avoid unexpected behavior, consider specifying explicit Solidity versions in pragma statements.

Update: Not fixed. In the words of the Fei Team: “It is not possible due to dependence on solidity compiler version 0.6.6 due to Uniswap interfaces”.

[L05] Not checking for 0 addresses

Some constructors do not check that an initialized address is not 0. This could result in loss of control or locked funds. Examples include:

beneficiaryaddress in theLinearTokenTimelockconstructoradminaddress in theTimelockconstructor

Consider validating that addresses are not 0 to ensure contracts operate as intended.

Update: Fixed in PR#39.

[L06] Not using SafeMath and SafeCast

Throughout the codebase there are math operations that are not checked for overflow or underflow using the SafeMath library. Examples can be found in the following locations, however this list is not exhaustive:

- The

Rootslibrary - The

LinearTokenTimelockcontract - The

alreadyReleasedAmountfunction - The

_beforeTokenTransferfunction - The

checkAllocationfunction - The

getFinalPricefunction

Although we did not observe instances which appear at high risk of overflow, consider checking all math operations using SafeMath as a best practice. In addition, the getFinalPrice function casts an int256 value to uint256 without any checks. Consider using the SafeCast library to check casting operations.

Update: Partially fixed in PR#37 and PR#67. There are still some ocurrencies where SafeMath and SafeCast are not being used.

[L07] queueTransaction does not check transaction value

The queueTransaction function uses ETH in the Timelock contract to execute transactions. The contract is funded using the receive function, which can then be used to execute queued transactions. However, there is no easy way to withdraw ETH from the contract, and queueTransaction does not validate that ETH being sent in a queued transaction was provided for that purpose.

Consider making queueTransaction a payable function and validating msg.value == value to ensure proper allocation of funds. In addition, consider implementing a way to withdraw any remaining ETH from the contract after confirming success in the executeTransaction function.

Update: Not fixed. In the words of the Fei Team: “We want to minimize changes to forked DAO contracts”.

[L08] Re-implementing ECDSA signature recovery

The following functions include implementations of the ECDSA signature recovery function:

castVoteBySigin theGovernorAlphacontractdelegateBySigin theTribecontractpermitin theTribecontractpermitin theFeicontract

This function is already part of the OpenZeppelin Contracts, which has been audited and is constantly reviewed by the community. Consider importing and using the recover function from OpenZeppelin’s ECDSA library not only to benefit from bug fixes to be applied in future releases, but also to reduce the code’s attack surface.

Update: Not fixed. In the words of the Fei Team: “We want to minimize changes to forked DAO contracts”.

[L09] Transfers are not checked for success

The transfer and transferFrom functions return true upon success, but the return values are not checked when these functions are called. For example, transferFrom is called from the _deposit function and transfer is called from the _withdraw function, but these result are not checked for success. Currently, the protocol only handles ETH, FEI, and TRIBE tokens. However, if planning to incorporate other tokens in the future, they may not revert on failed transfers, thereby causing these functions to continue operation when they should abort. Consider using SafeERC20 to catch failed transfers.

Update: Partially fixed in PR#12. An assertion was added when calling the transfer function from the WETH contract. The Fei Team decided not to check the FEI and TRIBE transfer and transferFrom return values since they inherit their behavior from the openzeppelin-contracts’ ERC20.sol contract, which will revert if something goes wrong.

[L10] UniswapOracle does not allow overflow

The update function in the UniswapOracle contract does not allow the cumulative price variables to overflow, against the guidance of the UniswapV2Pair oracle specification. This means the update function will eventually fail, despite the fact that Uniswap is designed to handle this overflow correctly. Consider permitting overflows to conform to the Uniswap Oracle specification.

Update: Fixed in PR#37.

Notes & Additional Information

[N01] Commented out code

The setTimeWeight function contains two lines of commented out code without an explanation. As is, these lines provide little value and may confuse external contributors. Consider either removing these lines or providing an explanation. If they are placeholders for a future implementation, it may be better to track them in a separate document for discussion.

Update: Fixed in PR#34.

[N02] Functions return without parameters specified

The delegate and delegateBySig functions within Tribe.sol execute the _delegate function in return statements. However, delegate, delegateBySig, and _delegate do not have return parameters, so the use of return in these locations is confusing and misleading. Consider replacing these return statements with simple function calls.

Update: Acknowledged. In the words of the Fei Team: “Want to minimize changes to forked DAO contracts”.

[N03] GenesisGroup is a token unnecessarily

The GenesisGroup contract is a token, however this token’s use will last a maximum of 3 days. The GenesisGroup contract mintsFGENtokens to users that deposit collateral, and then burns all FGEN tokens when users redeem them for FEI and TRIBE tokens. Consider accounting for this GenesisGroup token allocation using a simple mapping, rather than by creating a separate token.

Update: Acknowledged. The Fei Team decided to keep the GenesisGroup as a token, since they expect secondary markets to exist to allow users exiting Genesis by selling their FGEN tokens.

[N04] Improper use of require

As outlined in the Solidity docs, require statements are to ensure valid conditions that cannot be detected until execution time, whereas assert statements should be to check invariants. Properly functioning code should never reach a failing assert statement.

The codebase includes several require statements used to check for conditions that should never happen. For example, require statements are used to check whether the total is less than the balance in _totalRedeemablePoolTokens and _redeemablePoolTokens. Given that a situation where balance is greater than total would constitute a failure of the internal system, this condition would correctly be checked by an assert statement. Consider updating error handling statements that check for properly functioning code to use assert statements instead of require.

Update: Fixed in PR#51.

[N05] Inconsistencies around time

While much of the codebase uses timestamps to measure time, some time intervals are measured instead as a number of blocks. In these instances, comments are used to indicate the time interval desired that led to the specified number of blocks, however, these comments use inconsistent methods of estimation.

For instance, in GovernorAlpha the votingPeriod value, 17280, is accompanied by inline documentation that assumes 15-second block times. In CoreOrchestrator, the INCENTIVE_GROWTH_RATE value has inline documentation that assumes 12-second block times. The whitepaper and other project documentation generally match this inline documentation.

Even when a number of blocks is converted to a time interval using a consistent block time assumption, those approximations can deviate from reality. Inconsistent block time assumptions only make things more confusing. Block times can and will be variable, and the actual current block times of the Ethereum network have been closer to ~13s. This means that the actual time intervals observed in production could deviate from the documentation by as much as 13%. For example, the votingPeriod value is documented as being equivalent to approximately three days, when, in reality, it would be closer to two days and fourteen hours – a significant deviation that could result in user confusion.

To reduce confusion and increase the predictability of time intervals, consider using block timestamps for time intervals where possible. Alternatively, document assumptions about block times clearly and consistently, and be sure to explicitly reflect the variability of the time intervals they represent.

Update: Fixed in PR#50. Now, block times are assumed to be of ~13s.

[N06] Inconsistent coding style

There are general inconsistencies and some deviations from the Solidity Style Guide throughout the codebase. Below is a non-exhaustive list of inconsistent coding styles observed.

While most public function names do not contain an underscore, some begin with one underscore and others begin with two underscores. For example:

Some internal function names start with an underscore, while others do not. For example:

_writeCheckpointandsafe32are bothinternalfunctions in theTribecontract._setBeneficiaryandsetLockedTokenare bothinternalfunctions in theLinearTokenTimelockcontract.

Some parameters end with an underscore, while most do not. For example:

- The

delay_parameter in thesetDelayfunction - The

pendingAdmin_parameter in thesetPendingAdminfunction

Some lines of code are very long. For example:

- The

proposefunction definition is 139 characters long. - The

getActionsfunction definition is 164 characters long.

Some string literals are surrounded by double quotes ("), while others are surrounded by single quotes ('). For example:

- The

Feiconstructor uses double quotes to pass strings to theERC20function. - The

Feiconstructor uses single quotes to pass a string to thekeccak256function.

There is mixed use of spaces and tabs for indentation. For example:

- The

incentivizefunction uses a mixture of spaces and tabs for indentation, sometimes on the same line.

Some functions use named return variables, while others do not. For example:

- The

IDOOrchestratorcontract’sinitfunction declares named variables for returned values. - The

ControllerOchestratorcontract’sinitfunction does not declare a named variable for the returned value.

Consider enforcing a standard coding style, such as that provided by the Solidity Style Guide, to improve the project’s overall legibility. Also consider using a linter like Solhint to define a style and analyze the codebase for style deviations.

Update: Fixed in PR#54.

[N07] Inconsistent error message format

Error messages in the codebase follow different formats. In particular, messages from the dao contracts conform to the format Contract_Name::Function_Name: message, while other messages (like those in the GenesisGroup contract) conform to the format Contract_Name: message. To improve readability and facilitate debugging, consider following a consistent format across all error messages.

In addition, some error messages reference an incorrect function name, such as those found in the transferFrom function, the _moveDelegates function, and the Timelock constructor. These should be resolved.

Update: Fixed in PR#47.

[N08] Inconsistent methods for retrieving cumulative price from Uniswap oracle

The update function in the UniswapOracle contract uses the currentCumulativePrice function of the UniswapV2OracleLibrary library to retrieve the cumulative prices and timestamp from the Uniswap oracle, whereas the _init function in the same contract retrieves the same values using separate individual functions. To improve legibility and facilitate refactoring, consider using a consistent method for retrieving cumulative prices from the Uniswap oracle.

Update: Fixed in PR#46.

[N09] Incorrect GovernorAlpha name constant

The GovernorAlpha contract is forked from Compound, and maintains the name constant “Compound Governor Alpha”. Consider updating this to reflect the FEI protocol using the TRIBE governance token.

Update: Fixed in PR#35.

[N10] Interfaces omit some external functions

Throughout the codebase there are instances of interface contracts omitting some of the public or external functions that their corresponding implementation contracts define. Some examples include:

IBondingCurveOracleomits theinitialPricefunction that is implemented inBondingCurveOracle.IFeiomits thepermitfunction that is implemented inFei.IGenesisGroupomits theburnFromfunction that is implemented inGenesisGroup.IPoolomits theburnFromfunction that is implemented inPool.IUniswapPCVControlleromits theminDistanceForReweightthat is implemented inEthUniswapPCVController.

Incomplete interfaces may introduce confusion for users, developers, and auditors alike. To improve overall code legibility and minimize confusion, consider modifying the interface contracts to reflect all of the public and external functions from their respective implementation contracts.

Update: Fixed in PR#53.

[N11] Uninitializable global variable in LinearTimelockToken

The lockedToken global variable in the LinearTokenTimelock contract is only initializable by the internal setLockedToken function. As is, the lockedToken variable can only be initialized by inheriting the contract and calling the setLockedToken function. Consider making the contract abstract to indicate that inheriting contracts need to complete the implementation. Alternatively, consider initializing the lockedToken variable in the LinearTokenTimelock constructor.

Update: Fixed in PR#39.

[N12] Constants not explicitly declared

There are occurrences of literal values being used with unexplained meaning. Some examples include:

- The literal value

10000on line 22 ofBondingCurveOrchestrator.sol - The literal value

-1that is often used to represent an approval of ‘infinite tokens’ inTribe.soland throughout the codebase - The literal value

2**112on line 60 ofUniswapOracle.sol

Literal values in the codebase without an explained meaning make the code harder to read, understand and maintain for developers, auditors, and external contributors alike.

Consider defining a constant variable for every magic value used, giving it a clear and self-explanatory name. Additionally, for complex values, inline comments explaining how they were calculated or why they were chosen are highly recommended.

Update: Partially fixed in PR#41. Only the occurrences of magic constants mentioned above were explicitly declared.

[N13] Missing and incomplete event emissions

Several constructors do not emit events after initializing sensitive variables in the system, but when those variables are updated using setter functions, an event is emitted. For example:

- The

Corecontract constructor does not emit theFeiUpdateevent. - The

OracleRefcontract constructor does not emit theOracleUpdateevent. - The

BondingCurvecontract constructor does not emit theScaleUpdateevent.

Some setters, like the setGenesisGroup function, do not emit events. Whereas others, like the setFei function from the same contract, do emit an event.

Consider emitting events for all state changing functions, including those in contract constructors. In addition, consider emitting the old and new values in these XUpdate events to help track changes (e.g. ScaleUpdate(uint256 _oldScale, uint256 _newScale)).

Update: Partially fixed in PR#52. The Fei team elected not to change events to include old update values.

[N14] Naming issues hinder understanding and clarity of the codebase

To favor explicitness and readability, several parts of the contracts may benefit from better naming. Our suggestions are to rename:

statetogetProposalState.releaseWindowtoreleaseWindowDuration.timestamptotimeSinceStart.dandttodurationandtimePassed.dstthroughout Tribe.sol todestination.price0in thePCVDepositOrchestratorand correspondinginterfacetoisPrice0._twfbto_timeWeightedFinalBalance.threeHalfsRoottothreeHalvesPowerortwoThirdsRoot.twoThirdsRoottotwoThirdsPowerorthreeHalvesRoot.calculateDeviationtodeviationBelowPeg.

Consider renaming these parts of the contracts to increase overall code clarity.

Update: Fixed in PR#43 and PR#31. Some of the suggestions above were implemented by the Fei team.

[N15] NatSpec comments missing

Many functions do not have NatSpec comments (such as those in the Timelock and LinearTokenTimelock contracts). Furthermore, some functions do not have any comments, for example those in the BondingCurve contract. While many of these functions implement an interface, where the interface does include NatSpec comments, there are several exceptions leaving some code undocumented. In addition, it may improve readability to provide NatSpec comments on the implemented function, rather than on the interface definition. Consider adding NatSpec comments to all public and external functions, and including more comments throughout function implementations.

Update: Partially fixed in PR#56 NatSpec comments were moved from the interfaces to the implementations, but some of these are still incomplete.

[N16] Using now instead of block.timestamp

There are instances in the codebase where now is used rather than block.timestamp to refer to the block time. This term can be misleading and is deprecated in more recent versions of Solidity. This is observed in the following contracts:

- Line 55 of

Core.sol - Line 123 of

GenesisGroup.sol - Line 40 and line 46 of

Timed.sol - Line 175 and line 251 of

Tribe.sol

Consider using block.timestamp for clarity and to facilitate future upgrades.

Update: Fixed in PR#42.

[N17] Proposals can be canceled in states that are unintuitive

The GovernorAlpha contract is a fork of a Compound contract by the same name. It is responsible for governance proposals, including proposal vote collection, creation, cancellation and execution.

The public cancel function allows a proposal to be canceled only if certain conditions are met. Specifically, if a proposal has already been executed, then it cannot be canceled. However, a proposal that has already been canceled can be canceled again, so too can a proposal that’s been defeated or has already expired.

To ensure proposal states align with user expectations, and to avoid any confusion for outside observers, consider also disallowing cancellations for proposals that are canceled, defeated or expired.

Update: Fixed in PR#61. Now, GovernorAlpha proposals can only be cancelled in Active or Pending states.

[N18] Proposal struct storage is inefficient

The Proposal struct uses 13 storage slots. To improve gas efficiency, consider reorganizing the attributes within the struct to reduce the storage to 12 slots, for example, by moving the bool canceled and executed attributes immediately after the proposer address.

Update: Not fixed. In the words of the Fei Team: “We want to minimize changes to forked DAO contracts”.

[N19] Redundant event definition

The KillSwitchUpdate event is defined on line 23 of the BondingCurveOracle contract. That contract inherits from IBondingCurveOracle, which inherits from IOracle where the same KillSwitchUpdate event is defined on line 12.

Consider removing redundant event definitions to improve overall code clarity and maintainability.

Update: Fixed in PR#52.

[N20] Some interfaces are not inherited

There are numerous interfaces that are not inherited by relevant contracts. Some examples include:

- The Orchestrator interfaces in the

CoreOrchestratorcontract. For instance, theIIDOOrchestratorand theIGenesisOrchestratorinterfaces, which are not inherited by theIDOOrchestratororGenesisOrchestratorcontracts, respectively. - The

TimelockInterfaceinterface, which is not inherited by theTimelockcontract. - The

CompInterfaceinterface, which is not inherited by theTribecontract.

Consider having contracts inherit from relevant interfaces wherever possible.

Update: Fixed in PR#7 and PR#10. The orchestrator variable was removed from the GenesisGroup contract, and the operator variable is now being used to check that the operator is allowed to perform sell operations.

[N21] Some interfaces are unnecessary or inconsistent with implementation

There are some interfaces used that may be unnecessary or are inconsistent with their implementations.

- For instance, the

IOrchestratorinterface is defined and used for theorchestratorvariable, but thisorchestratorvariable is never used. -

In another case, the

IIncentiveinterface defines anoperatorargument as part of theincentivizefunction, but this argument is never used in the implemented function.

Consider either removing unused interfaces and arguments, fully implementing them, or modifying them to be consistent with their implementations where appropriate.

Update: Fixed in PR#53.

[N22] Test and production constants in the same codebase

The CoreOrchestrator contract defines the TEST_MODE boolean variable which is used to define several constants in the system. This decreases legibility of production code, and makes the system’s integral values more error-prone. Consider instead having different environments for production and testing, with different contracts.

Update: Fixed in PR#38. All the test constants were removed from the master branch.

[N23] Unnecessarily small integer sizes

In Solidity, using integers smaller than 256 bits tends to increase gas costs because the Ethereum Virtual Machine must perform additional operations to zero out the unused bits. This can be justified by savings in storage costs in some scenarios, however, that is not generally the case in this codebase. In several contracts, unsigned integers are being unnecessarily sized less than 256 bits. Examples include:

- The

uint128variables in thePoolcontract - The

uint96variables in theTribecontract - The

uint32variables in theTimedcontract

In some instances, these smaller integer sizes can cause function reverts earlier than necessary. In particular, since the _timestamp and _initTimed functions cast block times to uint32 values, functions using the Timed contract to manage control flow will revert beginning February 7, 2106 at 6:28:16 AM GMT.

Consider using integers of size 256 bits to improve gas efficiency and mitigate function reverts.

Update: Partially fixed in PR#37, PR#44. In the words of the Fei team: “We are not fixing the issue in Tribe.sol as this is a forked Compound contract and we wish to keep it as untouched as possible”.

[N24] Unnecessary if statement

The availableForRelease function fetches the elapsed time since the start timestamp using the timestamp function inherited from the Timed contract. It then checks if this is larger than duration, and if so, caps the value at duration. However, the timestamp function from the Timed contract already caps the result to duration, so this if statement will never be executed and is unnecessary. Consider removing this if statement.

Update: Fixed in PR#8.

[N25] Unnecessary imports

Some Solidity files are unnecessarily imported.

– Core.sol imports IFei.sol unnecessarily, because Fei.sol already imports IFei.sol.

– Core.sol imports IERC20.sol unnecessarily, because IFei.sol already imports IERC20.sol.

– Pool.sol imports SafeMathCopy.sol without using it.

– BondingCurve.sol imports AccessControl.sol without using it.

– EthUniswapPCVController.sol imports IOracle.sol without using it.

– UniswapIncentive.sol imports IOracle.sol without using it.

Consider removing redundant and unused imports to improve legibility.

Update: Fixed in PR#45.

[N26] Unreachable, incorrect error message

In the calculateDeviation function in the UniRef contract there is a subtraction with a provided error message argument. This error message is logically unreachable, but it is also incorrect. It currently reads “UniRef: price exceeds peg”, but should read “UniRef: peg exceeds price“.

Consider removing or correcting the error message to improve code clarity.

Update: Fixed in PR#37.

[N27] Unnecessary inheritance

The following contracts inherit both ERC20 and ERC20Burnable:

Inheriting ERC20 is unnecessary where ERC20Burnable is inherited, because ERC20Burnable already inherits ERC20. Inheriting both contracts can be confusing, especially where calls to super functions are made. To improve readability of these contracts, consider removing the ERC20 inheritance.

Update: Fixed in PR#32.

[N28] Use of uint instead of uint256

Across the codebase, there are hundreds of instances of uint, as opposed to uint256. In favor of explicitness, consider replacing all instances of uint with uint256.

Update: Fixed in PR#54.

Conclusions

5 critical and 3 high severity issues were found. Some changes were proposed to follow best practices and reduce the potential attack surface.